- #BREAK EVEN POINT FORMULA IN COST ACCOUNTING HOW TO#

- #BREAK EVEN POINT FORMULA IN COST ACCOUNTING FULL#

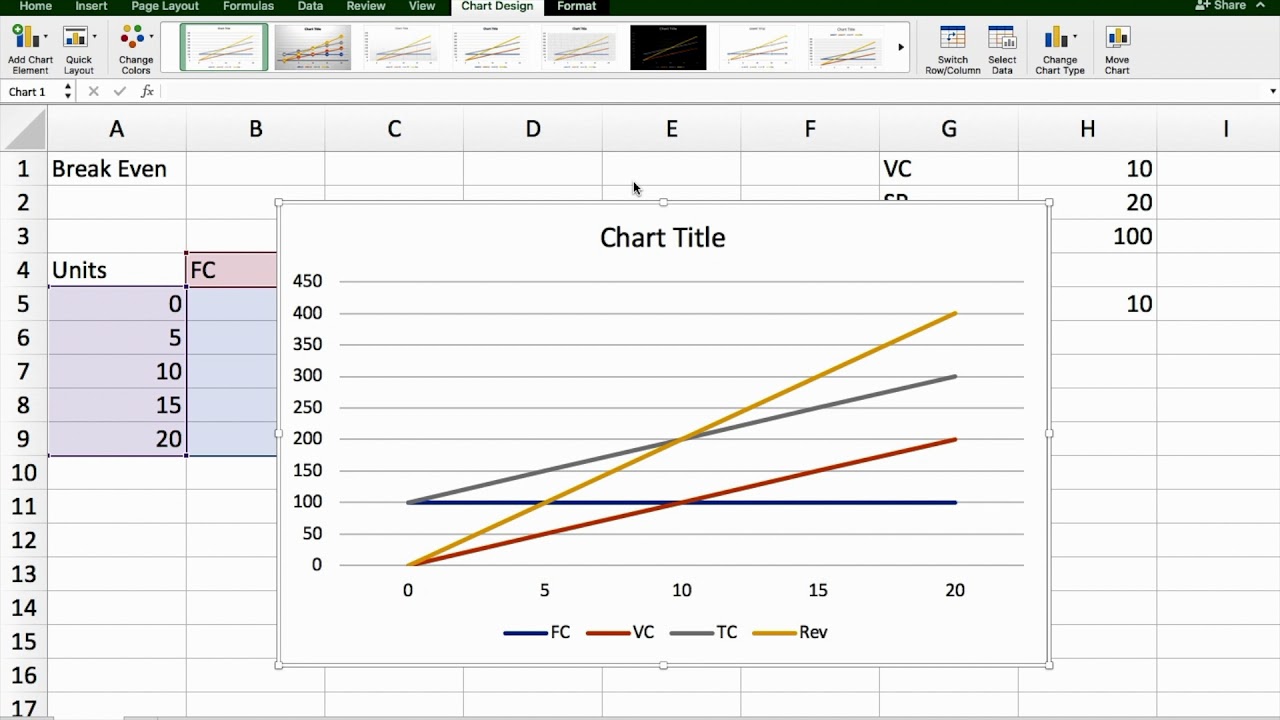

There are various ways to lower your break-even point. Components that impact profitability and, as a result, break-even point: In short, a sensitivity analysis can improve the resiliency of your business. Need to know the effect of a 10% drop in your sales? Or the impact of a 5% increase in the cost of your materials? A sensitivity analysis will provide answers and allow you to prepare a strategy to deal with these eventualities. To understand the effect that different variables’ fluctuations have on your business’s profitability, you’ll need to use a financial model called a sensitivity analysis. “But remember there are only a few components that can be adjusted-indirect costs, and gross margin percentage, through either volume of sales in units, unit selling price or cost per unit.” Perform a sensitivity analysis It’s important to make adjustments, if needed,” says Fontaine. The same exercise could also be done using a range of gross margin percentages.” You’ll then see a range of break-even points. “Try calculating break-even using examples of $200,000, $250,000 and $350,000 in total indirect costs. When calculating your initial break-even point, you’ll need to establish a range of scenarios.” “For example, if total indirect costs are now trending more towards $350,000 instead of $250,000, your break-even point will now be higher, at $1.4 million. Unfortunately, the reality is that after a month or two, or a quarter or two, you may have to re-visit that break-even point,” explains Fontaine. In a perfect world, you would meet all components of your budget. “Let’s say that with estimated total indirect costs of $250,000 and a gross margin percentage of 25%, you calculate that you’ll need to achieve $1 million in revenue to break even. It can be easy to convince yourself to increase indirect costs to drive business growth, but if you do so in advance of the additional business, you will need to clearly understand the impact that these additional costs will have on the new volume.” The break-even rangeįontaine says that since every business experiences fluctuations in revenue, the break-even point should be thought of as a range, rather than a specific number.

#BREAK EVEN POINT FORMULA IN COST ACCOUNTING FULL#

“Sometimes, the most difficult part for entrepreneurs is to realize the full impact of indirect costs on overall profitability.

#BREAK EVEN POINT FORMULA IN COST ACCOUNTING HOW TO#

When to use a break-even analysisĪ break-even analysis is essential for understanding how your business is doing and how to press on, according to Fontaine. A break-even analysis reveals how the break-even point changes for adjustments such as the unit’s selling price. The break-even point, on the other hand, establishes a threshold for success and helps set clear sales targets. “So, the formula is the same: indirect costs divided by your gross margin percentage.” The difference between break-even point and break-even analysisĪ break-even analysis looks at where your business is headed and what course of action might be taken to reduce your break-even point and increase profit. A consulting business would be a good example of that,” Fontaine explains. The only difference would be in the type of volume it sells, for example, number of hours instead of number of units or products. “The service industry also has indirect costs and gross margin values. Growth & Transition Capital financing solutionsĬalculating the break-even point for a service businessĭespite their trade not being in units, companies that provide a service can still calculate their break-even point. Kauffman Fellows Program Partial Scholarship Venture Capital Catalyst Initiative (VCCI) Industrial, Clean and Energy Technology (ICE) Venture Fund

0 kommentar(er)

0 kommentar(er)